Emergency Banking Act of 1933:What was it, its Purpose, and Importance

Jan 01, 2024 By Susan Kelly

Are you someone who recently read up on the Emergency Banking Act of 1933 and wanted to gain more information on it? Well, lucky for you, you have landed on the right page.

The Emergency Banking Act of 1933 was one of the most crucial aspects of finance history and is one of the most essential steps taken in the banking sector of the United States. Want to know more about this act? We have it covered for you below.

What was the Emergency Banking Act of 1933?

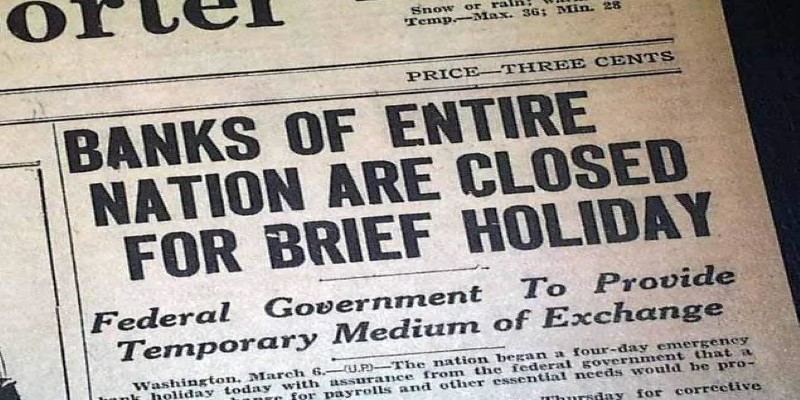

The Emergency Banking Act of 1933 was a bill that was passed in the midst of the Great Depression. This step aimed to stabilize and restore confidence in the US banking system. The act was signed by President Franklin D. Roosevelt on March 9th, 1933, after a weeklong bank holiday.

What is the History and Purpose of the Emergency Banking Act of 1933?

Though you understand why the Emergency Banking Act of 1933 was brought forward, do you want to read more about its history? Well, during the great depression, a lot of loans were made by banks in the 1920s, which were then not repaid. With the loans being unpaid, the banks started to fail, and a lot of depositors lost their money. As a result of this, many people started withdrawing their money from their bank accounts as they had lost trust in the workings and integrity of the banking system.

Despite the attempts of several states in the United States to restrict these withdrawals, many people no longer trusted the domestic banking system. They considered it a significant risk to keep their money with the banks. The Emergency Banking Act of 1933 provided a solution to this problem.

The bill for this act was drafted under former president Herbert Hoover. However, its actions were not administered until the rulership of President Franklin D. Roosevelt (1932-1945). Following his inauguration, Roosevelt called in a session and declared a four-day holiday for all banks within the country.

Shortly after this, Roosevelt addressed the country in his first fireside chat regarding his decision to implement the legislation. He explained to the people that this law was a rehabilitation program for American banking facilities. He further mentioned that the four-day holiday, which he had announced, was for the inspection of the bank's financial operations by the Treasury Department. Through all of this, Roosevelt reinstalled public confidence by emphasizing that it would be safer to deposit the money when the banks reopened instead of having to keep it under the blanket.

What Were the Five Legislations, and Why Were They Important?

The Emergency Banking Act was a legislation that was divided into five sections:

Title 1:

Title 1 was legislation that helped increase the presidential powers during a banking crisis to include the supervision and control of the banking functions within the United States. These banking functions include foreign exchange transactions, credit transfers between financial institutions, payments by financial institutions, and other activities related to gold and silver.

Title 2:

Title 2 helped enhance powers within the Office of the Comptroller of Currency (OCC). The OCC is an independent division within the Treasury Department that is responsible for looking into aspects of the management of financial institutions like liquidity, capital requirements, market risk compliance, etc.

The legislation allowed the OCC to limit the operations of banks with impaired assets. According to this legislative title, a conservator was to be assigned to the banks that would closely monitor their function.

Title 3:

The third title on the list of the Emergency Banking Act gave the Secretary of the Treasury the powers to decide if a bank needed more capital in order to sustain itself. In case the bank needed more capital, the bank could then receive it through the approval of the United States President; after receiving the president’s approval, the bank would then proceed to issue preferred stocks or seek a loan from the reconstruction finance corporation that backed the preferred stock.

Title 4:

Title 4 allowed the Federal Reserve to issue the Federal Reserve Bank Notes in case of an emergency. The Federal Reserve Bank Notes compromised currency, which was secured by the financial assets of the commercial banks.

Title 5:

Title 5 was the simplest out of all the Emergency Banking Act legislatives. This title allowed the Emergency Banking Act of 1933 to be effective by all measures.

Was the Emergency Banking Act a Success or Failure?

You must now be wondering whether the Emergency Banking Act, which was implemented, was a success or failure. Well, to answer it for you, the act was indeed a success. In immediate terms, the confidence of the people, which had been lost, was restored, and the customers brought back their money, which they had initially withdrawn from the banks to deposit again.

While the act was implemented in 1933, today, decades later, the FDIC continues to support the bank customer’s confidence by insuring their deposits for them.

Wrapping Up!

The Emergency Banking Act helped secure and support the falling banking system of the United States after the great depression. It was a result of the intelligent thinking and immediate workings of both the banking and government setups during that time. However, the practical measures that were taken back then are helping the banking system flourish to this day. If you are someone who wants to read up on the Emergency Banking Act of 1933, then we hope this article is sufficient enough to answer your questions.